In this article: Learn how you can contribute to your family’s income as a SAHM who doesn’t bring in any outside income.

For 18 years I have been a stay at home mom. And I am sure I don’t have to tell you how hard that is at times. But one of the hardest things to deal with as a SAHM is the guilt.

** This website contains affiliate links. If you make a purchase using one of these links, I may earn a commission. Please click here for more information about cookies collected and our privacy policy **.

We just seem to feel guilty about everything, and if money is tight or if you are living month to month, that guilt of not bringing in any money to the household finances can feel crushing.

Logically we know that even if we did go get a job outside of the home, we would likely be sending all that money to child care costs. And logically we know that raising children is an important job. And even if our husband is supportive of us staying home to raise our families, that guilt can still be crushing.

In the past year our family situation has changed, and I now I earn the sole income for our family (from home), but for 16 years I dealt with that guilt of not being able to help support my family finances- through a huge debt load and living paycheck to paycheck.

But you know what? You CAN contribute to the family finances even if you don’t make any money. You can play an active part in what happens to the money after it is deposited in your bank account. So here are 4 tips to help you get rid of that guilt and start playing a more active role in your family finances.

4 Ways You Can Contribute To Your Family Finances When You Don’t Earn an Income

By Paying the Bills

This is the easiest way to contribute to your family’s finances. If you are not already, take over the accounting part of your household.

Pay all the bills, balance the checkbooks, write all the checks. Just because you don’t earn an income doesn’t mean you should be hands off when it comes to the finances.

By taking an active role in paying the bills you can take some ownership in the financial well being of your household.

By Saving Money

What’s that saying? A dollar saved is a dollar earned?

Even if you don’t earn any income, you can still save your family a lot of money, which in a way is making money.

Saving can mean a lot of things. It can mean using coupons or creating savings accounts to save for bigger purchases or as an emergency fund.

It can mean shopping for deals on the necessities of life. It can mean cutting out unnecessary purchases.

Whatever saving looks like to you, by taking on the job of saving your family money can help you feel like you are contributing to your family finances.

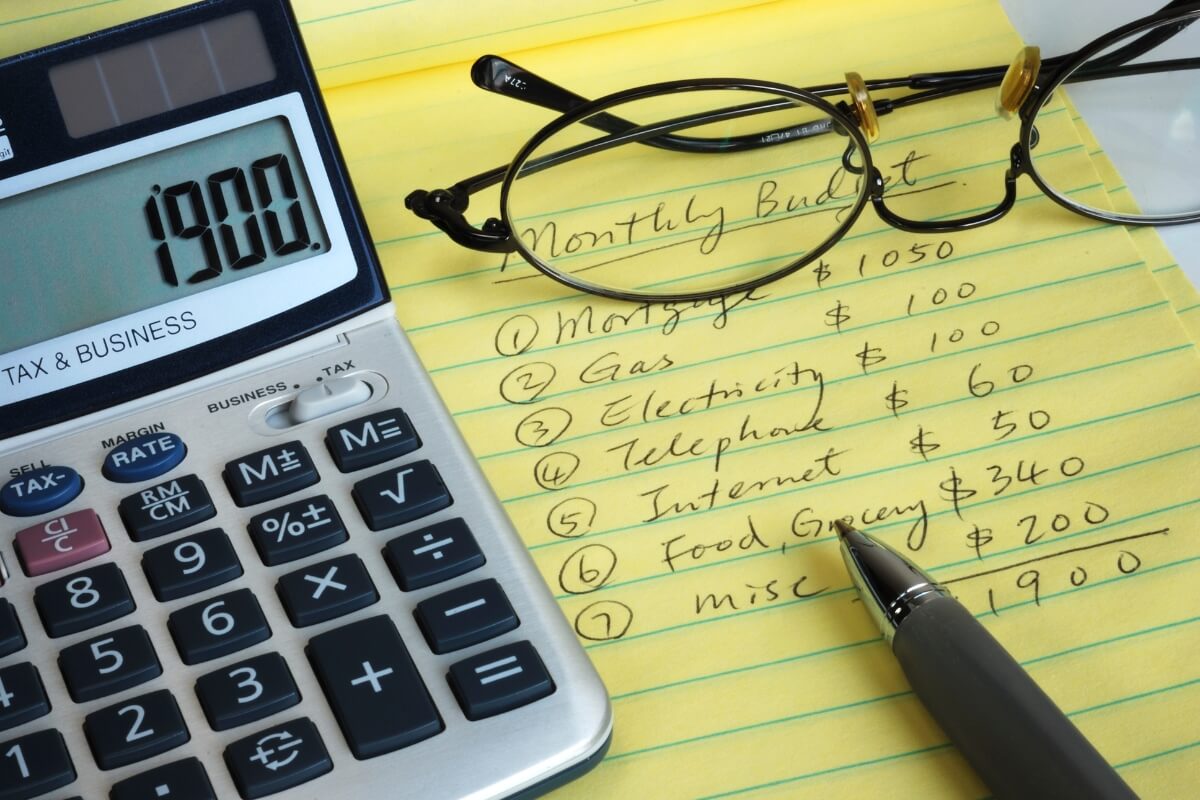

By Creating a Budget- and Stick to It!

A budget can make or break your household finances- especially if you are barely making ends meet.

A great way to contribute to your family’s finances when you don’t earn an income is to create your budget- and then make sure everyone sticks to it!

This works really well paired with the previous 2 ways to contribute to the finances. If you are already in charge of the bills and saving, it only makes sense that you are the one making the budget.

Print out one of these free Monthly Budget Planning worksheets to help you.

Not great in the budgeting area? Dave Ramsey is the go-to budgeting expert!

By Meal Planning & Preparation

Feeding a family is expensive! 3 times a day (or more), everyday- no matter how busy you are- you have to feed your family.

Meal planning and preparation is an often overlooked way of helping your family finances.

By careful planning of meals you can reduce grocery store costs and the expense of going out to eat when you need a quick meal and didn’t plan ahead.

Plus in addition to helping your family finances- you can also feel confident you are feeding your family healthy and nutritious meals too!

Check out these 2 articles to help cut costs when it comes to meals:

19 Ways to Save Money on Groceries

20+ Frugal Meal Ideas for When Money is Tight

Or print one of these weekly meal planners or grocery shopping lists to help keep you organized and on budget when at the store.

Okay- so there you have it, from someone who felt guilty for years about not bringing in any actual income- those are my top 4 ways to contribute to your family financially when you don’t earn any income.

Those are great ideas for contributing to family finances. I think my favorite point was that even if you don’t earn an income it is important to be involved in paying the bills so you know where things stand and you feel more connected to what is going on with the finances.